May 29, 2003

May 28, 2003

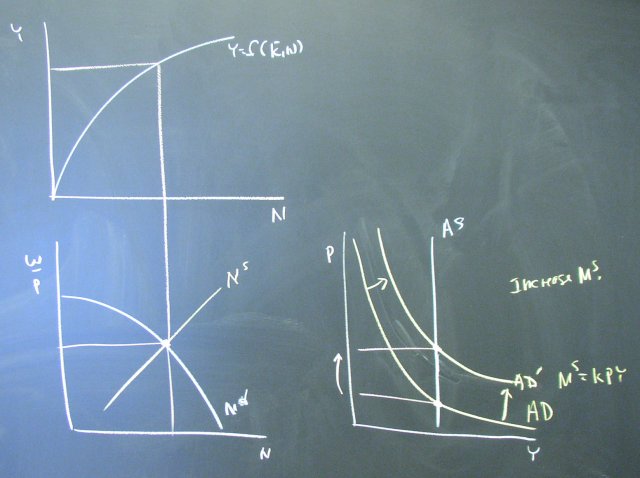

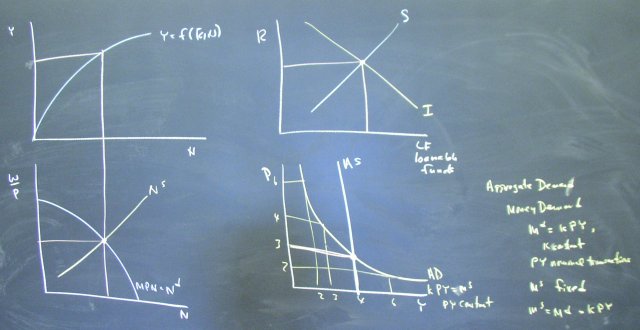

Completing the Classical Model

We added aggregate supply and aggregate demand and then studied the effects of an increase in the money supply.

Adding a diagram of the supply and demand for loanable funds completes the model:

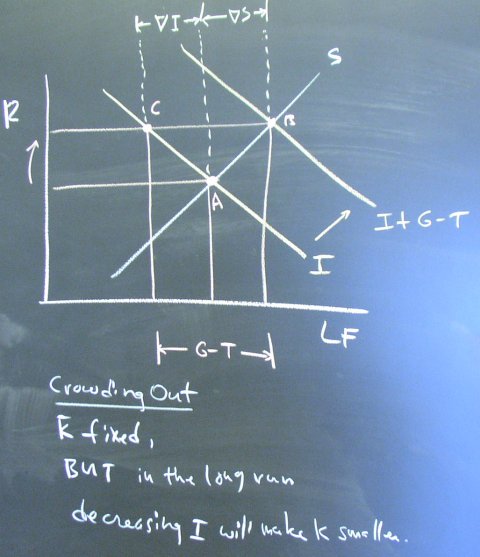

The effects of fiscal policy are largely confined to the loanable funds diagram:

May 27, 2003

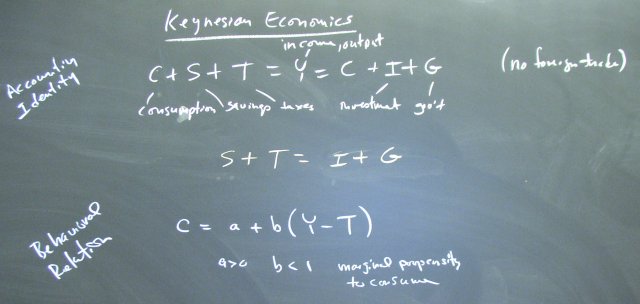

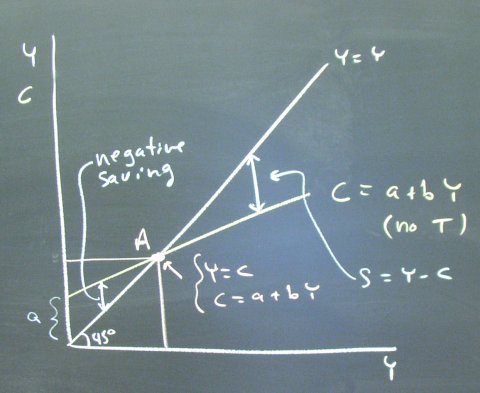

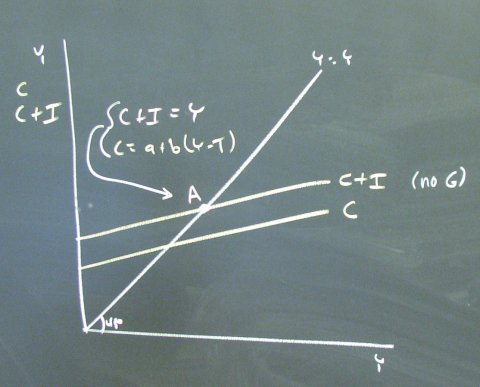

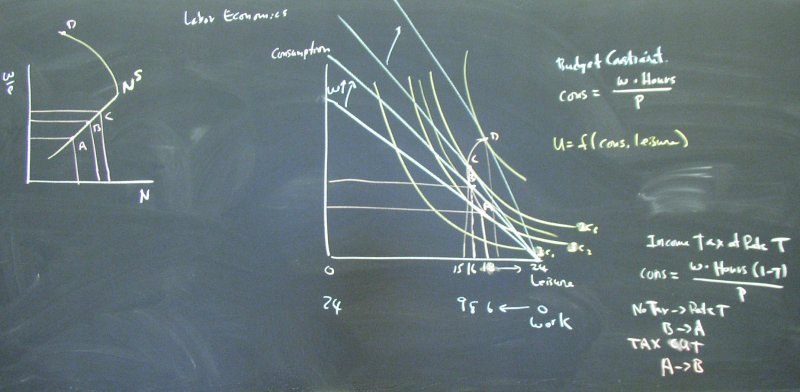

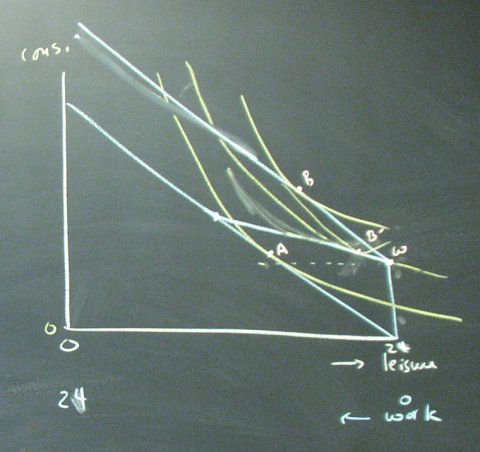

Theory of the Consumer

The basic Theory of the Consumer explains how we derive the demand for X1.

We extend this analysis to derive the supply of labor.

The labor supply curve is fundamental to the Classic Model. Here we analyze the effects of a cut in the income tax rate.

The welfare problem is an interesting extension of the labor-leisure tradeoff. The diagram with the point W shows how a rule that takes away all welfare benefits as a result of any work could keep people from working at all. We discussed a couple of alternative rules that generate budget constraints that might encourage people to move from W to some work.

May 22, 2003

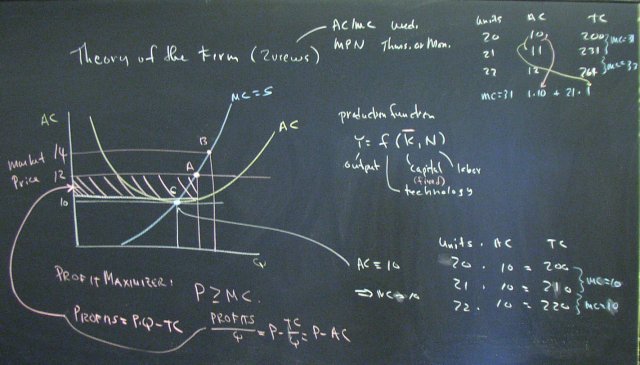

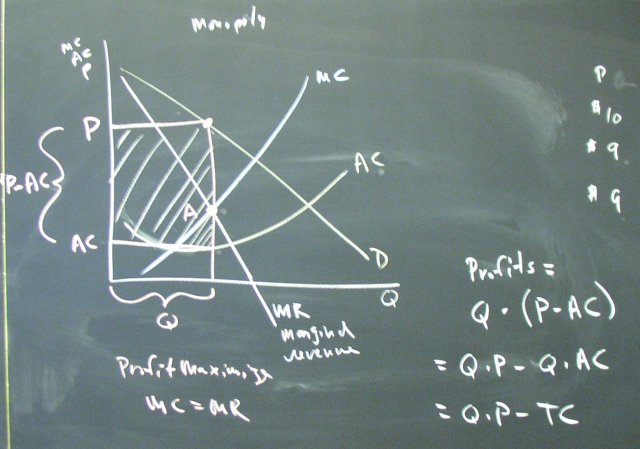

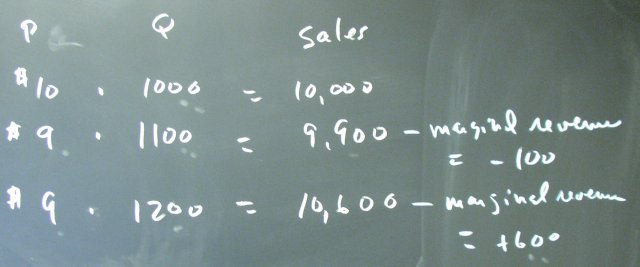

Theory of the Firm - Monopoly

A numerical illustration of marginal revenue:

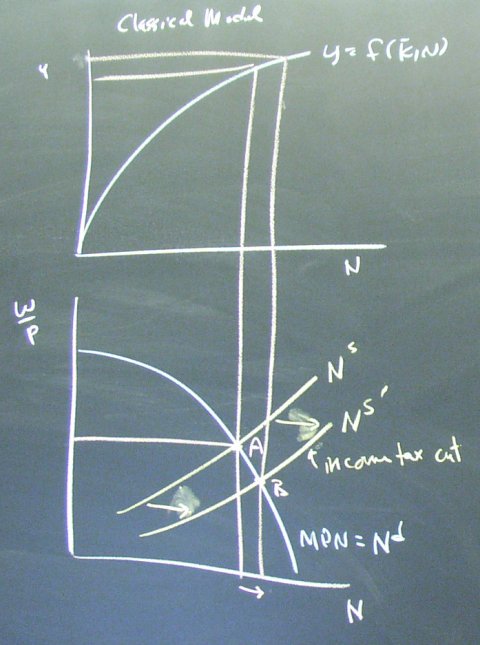

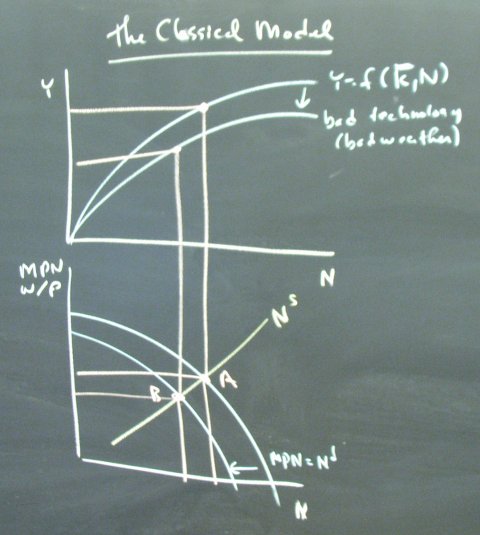

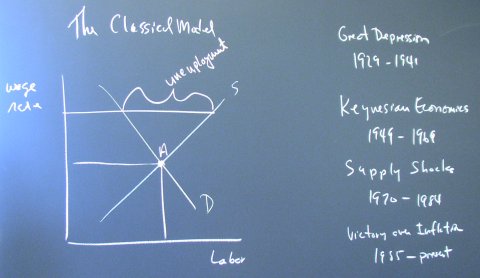

Preview of the Classical Model

Add a labor supply curve and we have a simple version of the Classical Model.

Also shown here is a business cycle caused by a negative shock to the production function.

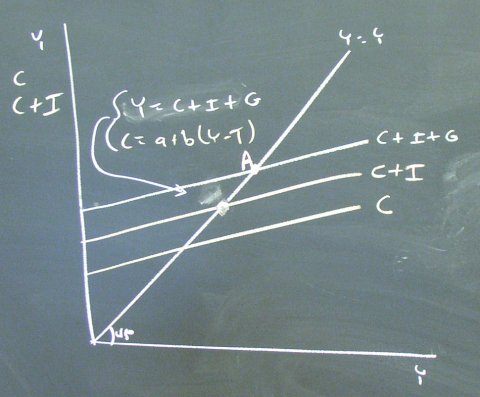

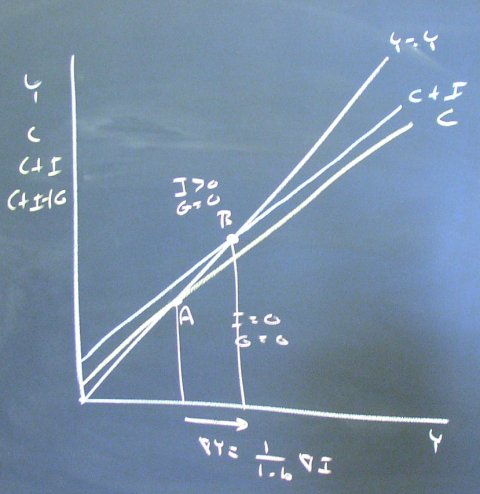

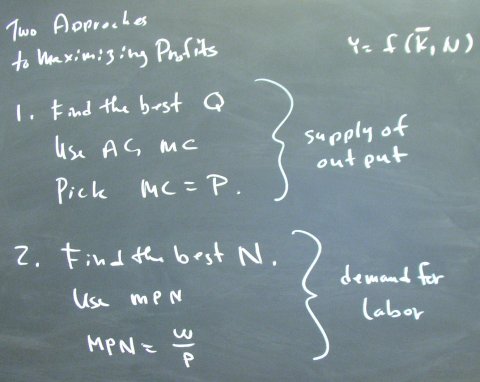

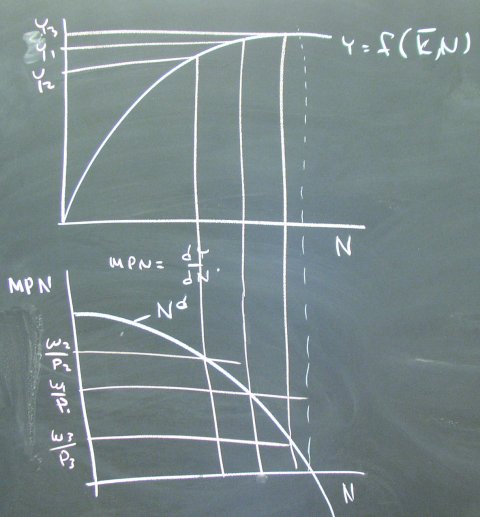

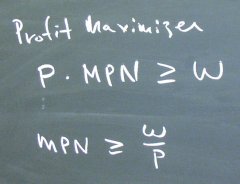

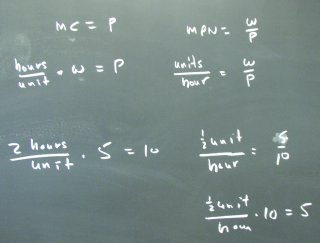

Theory of the Firm - II

Profit maximizing leads to the firm's demand for labor curve.

Showing that the two approaches to profit maximization are equivalent if the only variable factor of production is labor.

May 21, 2003

May 20, 2003

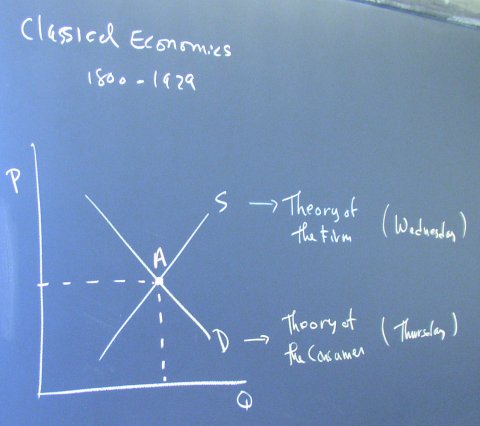

Introduction

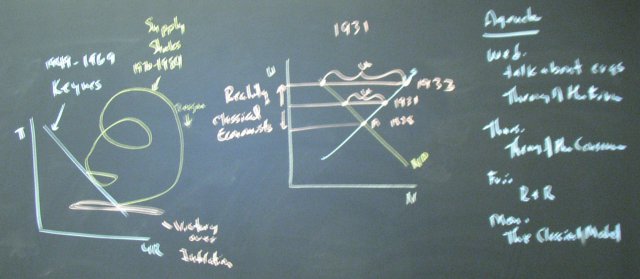

The great achievement of classical economics was explaining how free markets lead to an efficient allocation of resources.

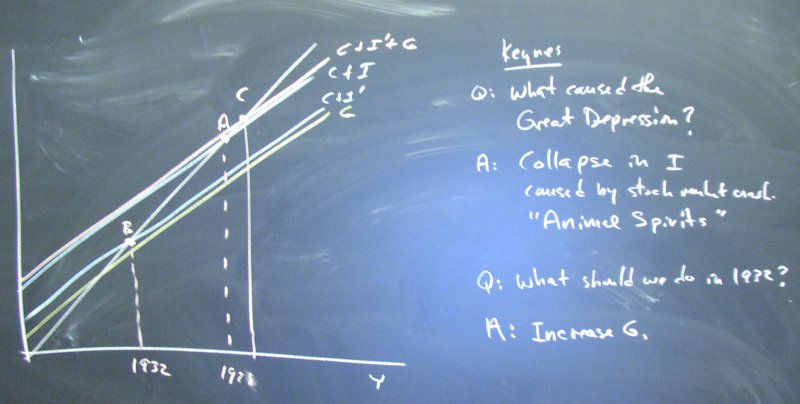

The achievement falls far short of explaining the persistence unemployment of the Great Depression.

Eras We Will Study

1800 - 1929 Classical Economics

1929 - 1941 The Great Depression

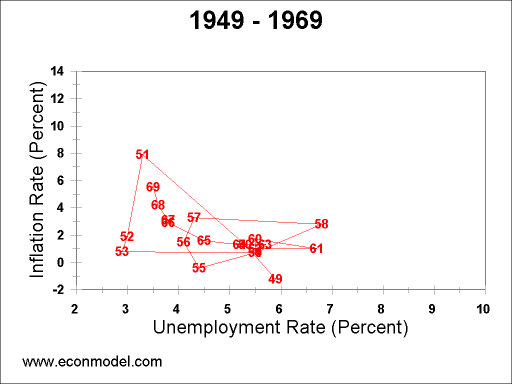

1949 - 1969 Keynesian Economics

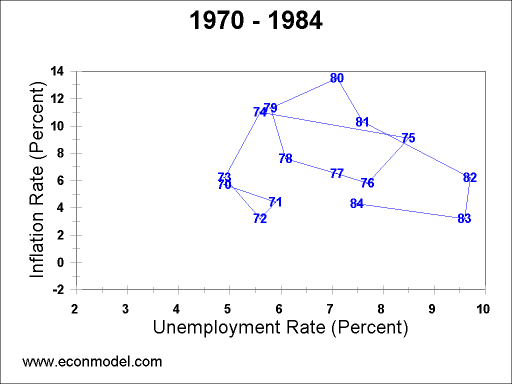

1970 - 1984 Supply Shocks

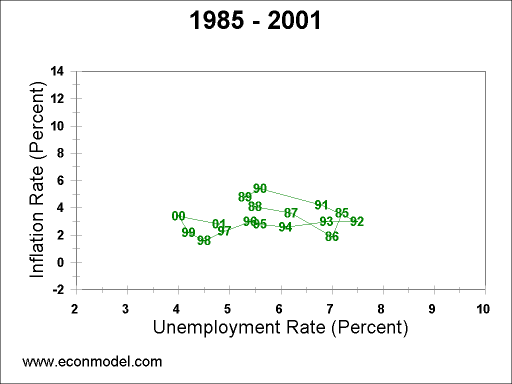

1985 - 2003 Victory Over Inflation