June 05, 2003

Tax Cuts

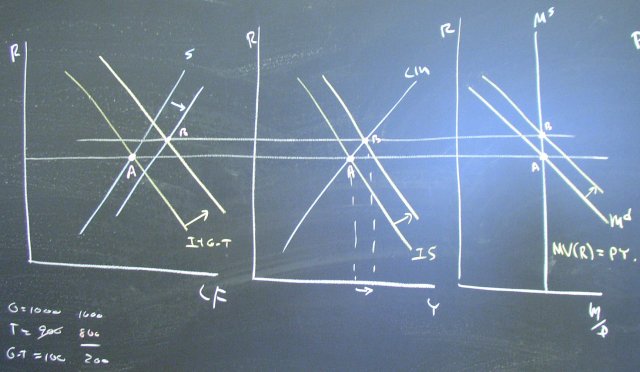

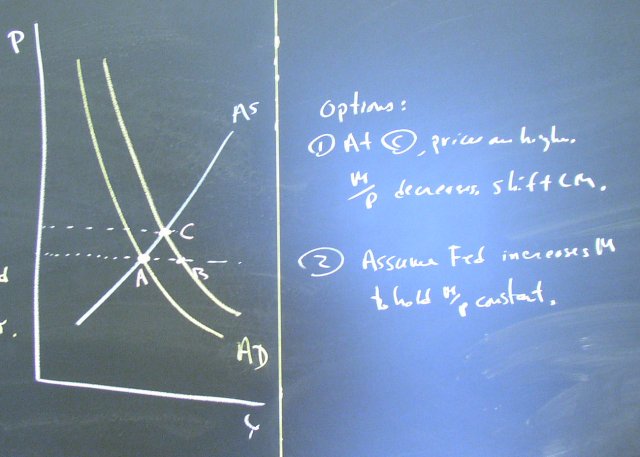

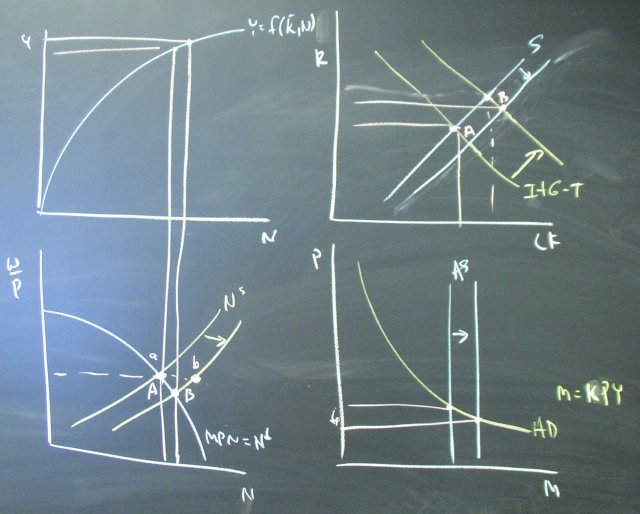

We compared the effects of marginal tax rate cuts and lump sum tax rebates under the Keynesian and Classical views.

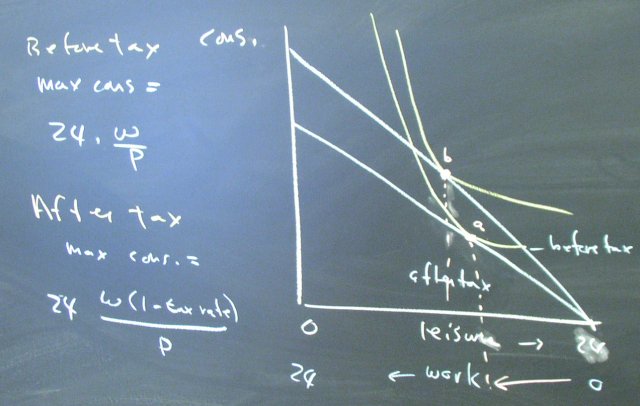

At a given wage rate, we expect a cut in the income tax rate to increase labor supply.

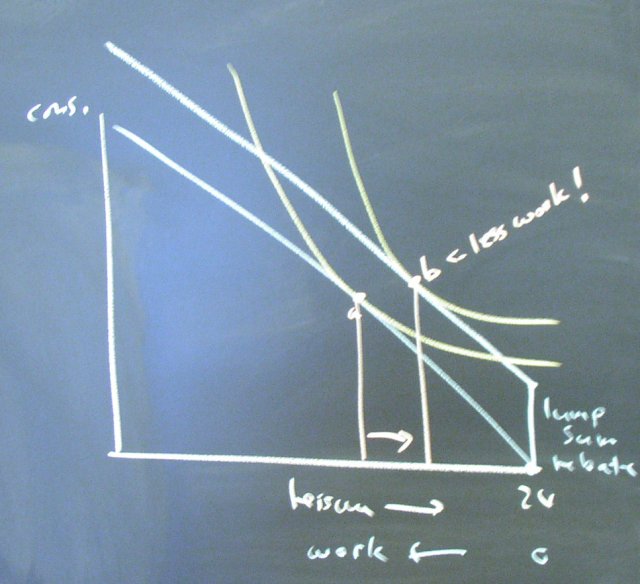

The effect of a lump sum rebate is not as clear. It could increase or decrease the labor supply at a given wage rate.